As of April 2024, the world's most valuable startup (Chinese ByteDance, owner of TikTok) was valued at 220 billion dollars, which made it the highest-valued unicorn worldwide. But not all startups turn into successful projects; 9 out of 10 startups fail.

The top three reasons for such failure? According to Failory, it's marketing mistakes, team issues and poor financial projections.

We trust you to handle your marketing strategy and build a strong team, but when it comes to finances and financial forecasts, the stakes are too high to rely on guesswork.

To overcome this hurdle, you need solid financial forecasting for startups that will help you identify potential risks, inefficiencies and growth opportunities that may have been missed by competition.

Contents

Financial forecasting predicts the upcoming cash flow your startup needs to handle its operating costs. It’s the most essential strategy element for both new and established companies.

Typically, the basic version focuses on the initial 18 months post-launch. However, most investors like to see a three-year prediction of future sales and losses in your business plan.

It should include a monthly sales forecast, predicted expense data and a gross profit and loss statement.

Financial statements allow you to attract investors, budget your first months in business and measure your actual performance against your anticipated operating costs. It’s a huge factor in:

Let's see what you need to create revenue projections and skyrocket your business development.

Total Addressable Market (TAM) is a term used to describe the overall revenue opportunity available in a market sector, assuming 100% market share is achieved. It helps startups understand their market domain’s potential scale and scope.

TAM helps startups to position themselves competitively and set realistic financial and operational milestones, laying down a blueprint for sustainable growth.

Pipeline forecast predicts future revenue by analyzing potential sales opportunities and their likelihood of closing. It weighs all the factors that play a part in each potential deal.

You can use a sales pipeline forecast to prioritize sales efforts, adjust marketing strategies and set realistic revenue targets.

An expense forecast outlines all anticipated fixed costs (salaries, rent, PTO, loans and insurance) and variable costs (cost of goods sold, commissions and royalties, marketing expenses) as well as operating expenses such as utilities, software subscriptions and office supplies, that a startup expects to incur in a specific period.

Subscribe to our newsletter

to get unlimited financial

content. And f🤑n.

hbspt.forms.create({ region: 'na1', portalId: '23433501', formId: 'a03e6662-eaae-45df-b0f9-f838e8716a32' });

By regularly reviewing and updating expense forecasts, startups make informed decisions about cost-cutting measures, investments and budget adjustments, reducing the risk of overspending.

A cash flow statement is a document that shows how much money is coming in and going out of a startup. It helps the startup know when it might have too much or too little money.

This is valuable for planning finance needs, managing debt, negotiating better terms with suppliers and making informed revenue and expense management decisions.

The P&L projection, or an income statement, estimates a startup's revenues, costs and profitability. It shows whether the business is generating profits or incurring losses. This revenue and expenses summary helps to identify areas where companies can increase revenue, decrease production costs and improve their overall profitability.

Gather and analyze your startup's historical financial statements, including:

This will help you identify consumer trends, understand seasonality and pinpoint areas where your business struggled or excelled in the past.

If you don't have any historical data yet, use industry trends and solid market research to show you understand your target audience and are driven by a clear vision.

Categorize expenses, bookings, billings and revenue streams and other financial metrics to make them readily accessible for analysis and projection. With a financial planning tool like Fuelfinance, you can use a top-down or bottom-up forecasting method.

See also: QuickBooks alternatives

Based on the gathered and sorted information, you can easily calculate the projected revenue. The best method for making accurate financial projections that are realistic is to consider multiple scenarios and plan for unexpected events.

Project cash flow, operating profit and loss and balance sheet statements for at least the next 12 months.

Financial forecasting is an ongoing process that requires startups to review and update their projections as new information emerges regularly. By doing this, startups can remain financially agile and responsive to changing market conditions.

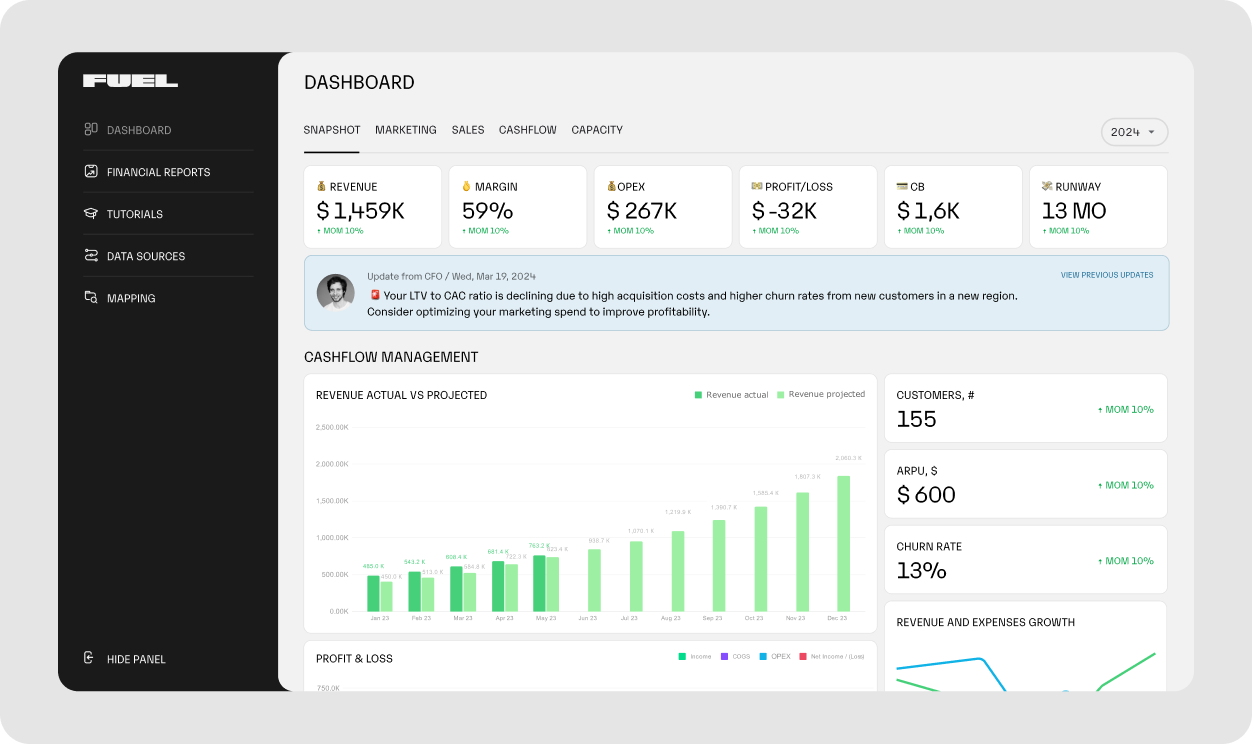

If you want to make your cash flow projections and financial planning easier and more precise, our financial forecasting software is the answer. Fuelfinance is a smart, automated and intuitive combination of cloud-based software and a team of financial professionals.

Financial forecasting for startups can be entirely automated and well-organized by integrating real-time financial data, using AI projections and eliminating manual spreadsheet updates. Automated data syncing pulls in financials from accounting, payroll and sales platforms, while AI forecasting tools generate multiple scenarios based on actual performance.

This means forecasts update instantly as new data comes in, ensuring accuracy and saving founders from endless number-crunching.

Fuelfinance also gives you a dedicated financial expert, acting as your fractional CFO and helping you make sense of all the numbers, providing unlimited support, guidance, and strategic insights tailored to the startup's specific needs.

Here’s the full scope of our capabilities:

By combining automation, AI-driven insights, and expert support, Fuelfinance transforms financial forecasting into a seamless and efficient process, allowing startup founders to focus on scaling their businesses with confidence. Sounds good? Sign up for a short demo call!

Keeping a close eye on your finances can make or break your business. Think about it: almost half of all startup hiccups are due to running out of cash. That’s a big deal! So, diving into financial forecasting isn’t just some fancy business jargon – it’s essential.

READY FOR FINANCIAL

P😌ACE OF MIND?

See what Fuel can do

for your biz.

Whether you need help drafting your startup’s financial plan, creating a cash flow statement or legal or financial advice, Fuelfinance has you covered. We act as your fractional CFO and financial modeling software with expert support, advanced automated forecasting, customizable financial modeling, unit economics and accounting, all in a cloud-based software, ensuring you never lose your data – or become overwhelmed by it.

Sign up for a quick demo to see how you can fall in love with your finances.

After gathering historical data, start with revenue projections, estimate costs and expenses, factor in growth assumptions and build cash flow statements, P&L and balance sheets for each year. Be realistic – no hockey-stick growth charts unless you’ve got a magic wand.

A financial projection example is predicting a startup's future net income and expenses, typically using past financial data and market trends to estimate the financial future.

Let’s say a SaaS startup projects $20,000 in monthly revenue, expects a 10% growth rate, and factors in operational costs, churn rate and customer acquisition costs to estimate cash flow over the next year. It helps them plan hiring, pricing and fundraising before money starts disappearing.

Take your expected sales, subtract expenses and map out how much cash you'll have at the end of each month. If the numbers turn red too soon, rethink your plan before your bank account throws in the towel.

To create financial projections in Excel, simply organize the data you collect in spreadsheets. Use formulas for revenue, expenses and cash flow to calculate projections and create charts to visualize results. Or, if you’d rather not risk a formula disaster, use an FP&A tool, like Fuelfinance that automates the whole thing.